Mortgage Compliance Management System

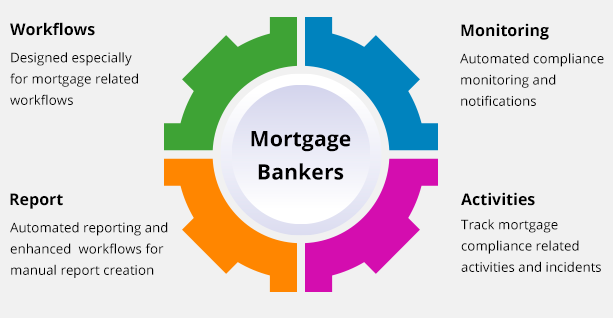

Mortgage compliance management system. The integrated approach enables banks to. You may say that you have all of your policies and procedures or that you do not need the consumer complaints policy and procedures because you do not receive any complaints. My Compliance Manager includes.

We are pioneers in outsourcing solutions for residential mortgage compliance. Completion of Level II is required to move on to Level III. Ad Explore Compliance Systems Other Technology Users Swear By - Start Now.

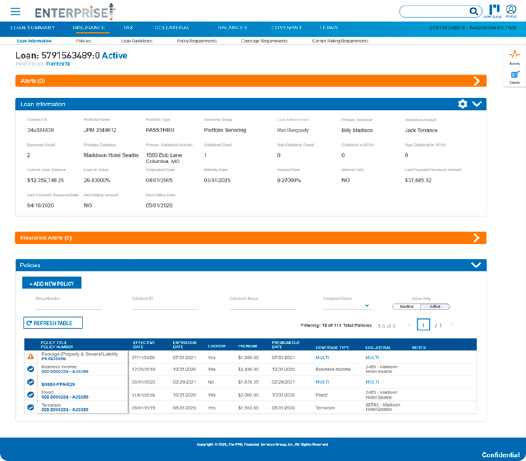

Policy and procedure management system. This manual also includes aids for the use of technology in the review of loan portfolios and the development of the Report of Examination ROE. Compliance Management System controls the flood.

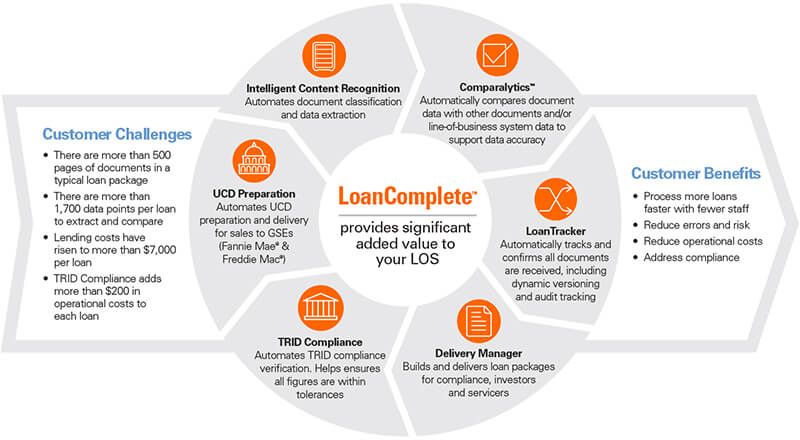

ML 10-16 also introduced HUDs Internet portal P260. We cover the various components of a good compliance management system and how they help a mortgage lender manage risk. Examination and licensing preparation.

My Compliance Manager includes. LENDERS COMPLIANCE GROUP is the first full-service mortgage risk management firm in the country specializing exclusively in residential mortgage compliance and offering a full suite of services in mortgage banking for residential mortgage lenders and originators. Streamline Your Process Now.

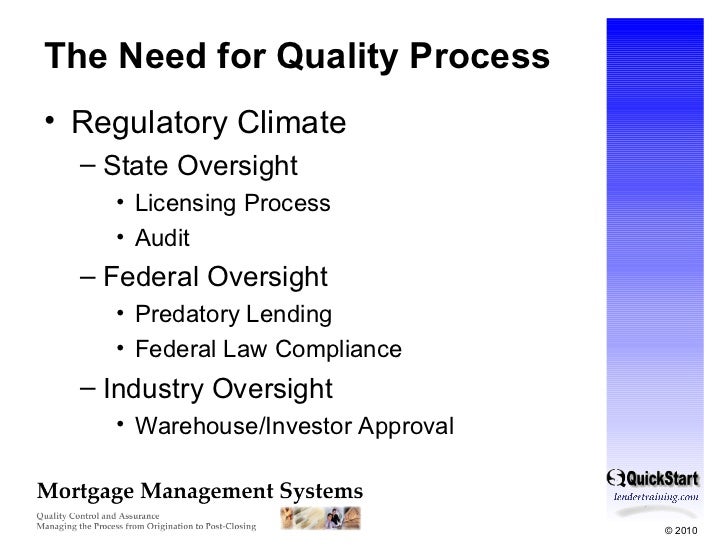

A CMS is how an institution. Mortgage Broker andor Non-Delegated Correspondent Compliance Management System Policies and Procedures Manuals Investor Approval Policies and Procedures Investors typically request copies of policies and procedures or require a certification that policies and procedures exist that show that their counter parties have the minimum policies and procedures that ensure an understanding and structure. According to the CFPB a compliance management system will have the following two elements.

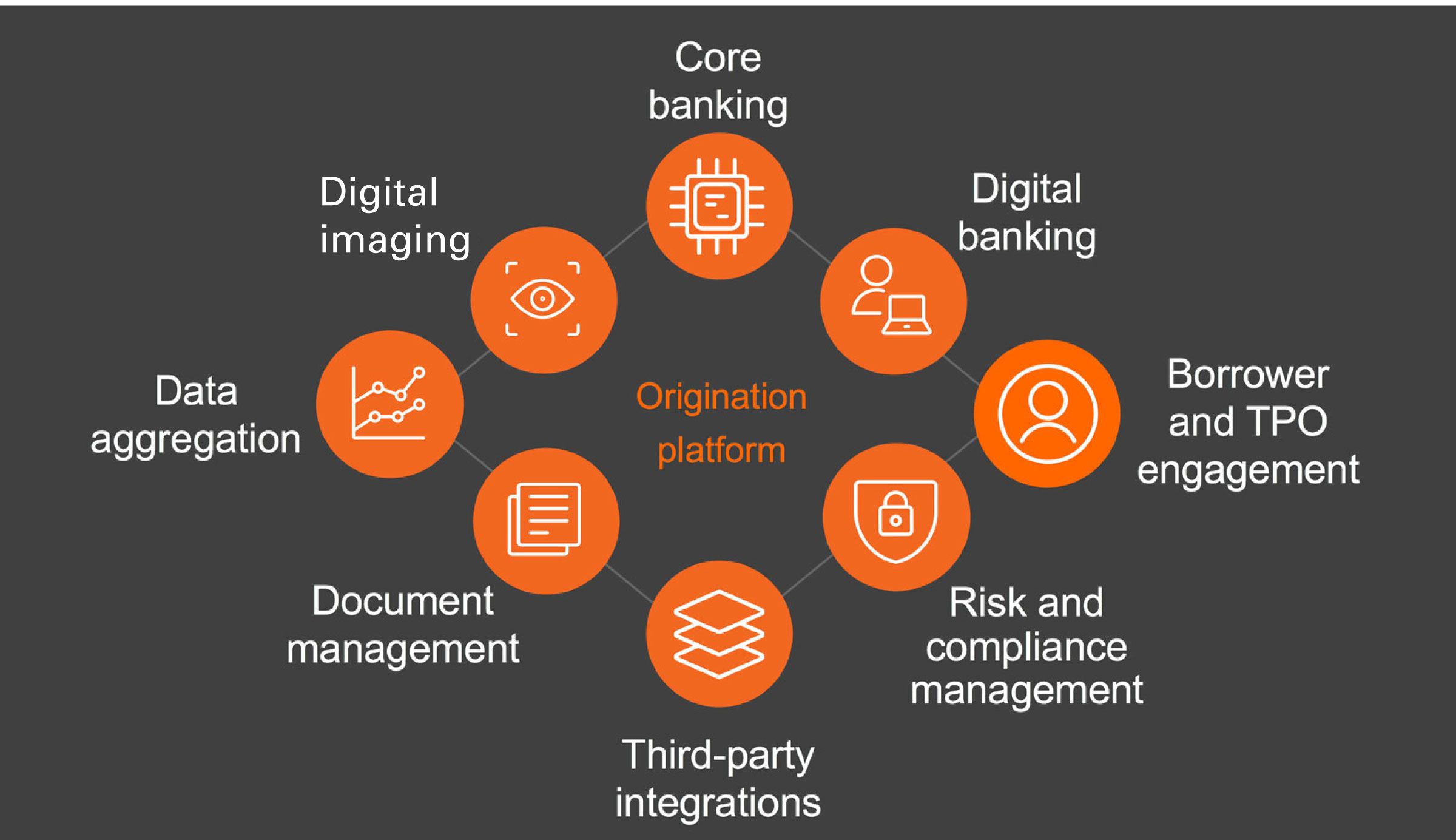

Under MM III all documentation related to Mortgagee compliance must now be electronically scanned and uploaded into P260. The Predict360 Risk and Compliance Intelligence platform brings all risk and compliance management activities under one platform allowing banks to synchronize and streamline risk and compliance processes while eliminating redundancies.

My Compliance Manager includes.

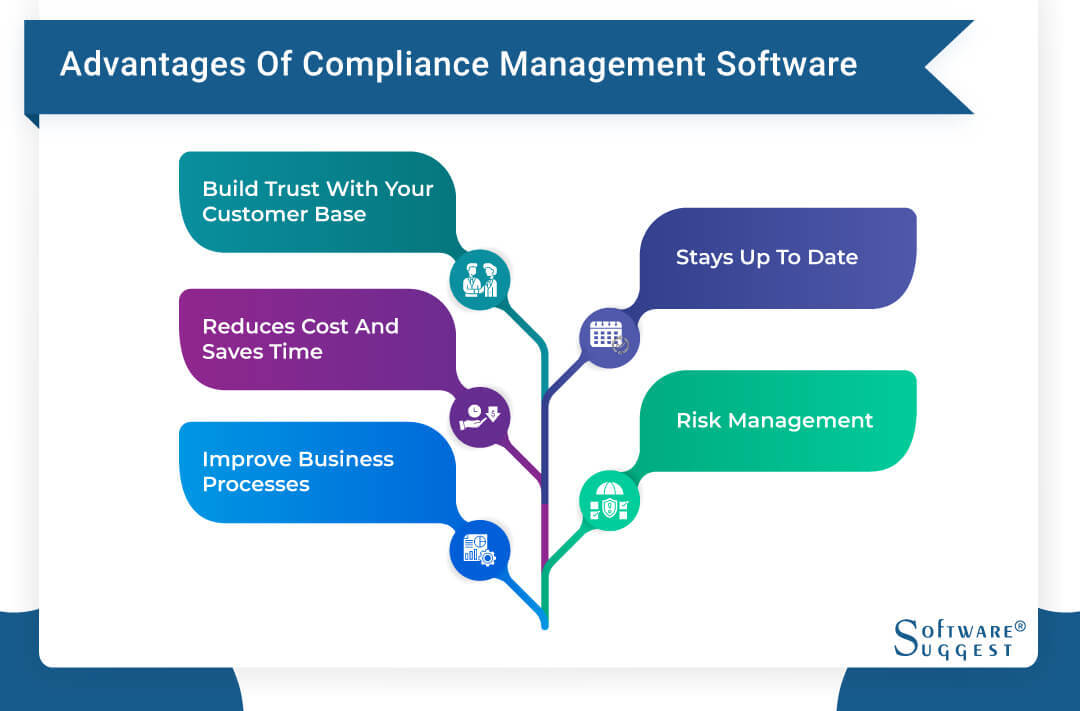

Policy and procedure management system. Go Beyond The Check-The-Box Approach With Customised Dynamic Workflows. The CMCP Specialist Designation shows your commitment to the highest standards of professionalism and dedication to supporting compliant lending practices in the mortgage industry. Ad Designed For Any Size Of Business Or Level Of Complexity. Examination and licensing preparation. We are pioneers in outsourcing solutions for residential mortgage compliance. Learns about its compliance responsibilities Ensures that employees understand these responsibilities Ensures that requirements are incorporated into business processes Reviews operations to ensure responsibilities are carried out and requirements are met. The Predict360 Risk and Compliance Intelligence platform brings all risk and compliance management activities under one platform allowing banks to synchronize and streamline risk and compliance processes while eliminating redundancies. A compliance management system should be designed to have two main elements and several subcomponents.

Compliance Management System controls the flood. The CMCP Specialist Designation shows your commitment to the highest standards of professionalism and dedication to supporting compliant lending practices in the mortgage industry. 1 DirectorSenior Management Update of recent changes 2 Policy Update to be incorporated into existing policy 3 Procedures Update covering ATRQM rules 3ATR coverage Flowchart 4 Higher-Priced Covered Transaction Coverage Flowchart 5 8 Factors Features Checklist 6 ATR Options Decision Tree 7 Prepayment Penalty Checklist 8 General QM Checklist 9 Balloon QM. Mandatory Federal compliance training for AML FACTA Fair Lending and others with online reporting and branded management site. Of a MMEs financial condition Compliance Management Systems CMS and forward and reverse mortgage loan origination and servicing activities. It consists of policies and procedures training and testing. We cover the various components of a good compliance management system and how they help a mortgage lender manage risk.

.png)

Post a Comment for "Mortgage Compliance Management System"